Checking accounts are a banking tool that helps you manage your finances. There are different types of checking accounts to meet various needs. However, all these accounts operate in a similar method. The best free checking accounts are those without a minimum balance or maintenance fee. These depend on the bank.

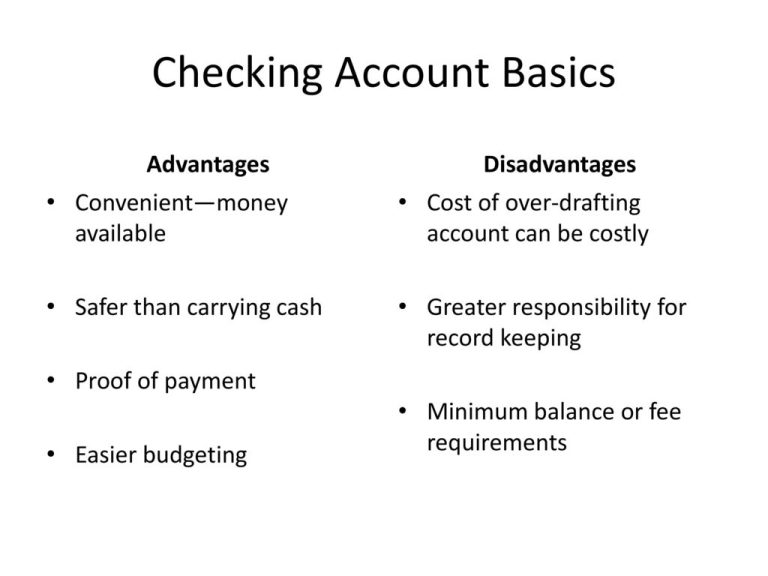

But before choosing the bank, you will have to weigh the advantages and disadvantages of checking accounts. Here is a quick look at these to help you choose. In addition to debit cards, e-cards are also becoming increasingly popular. E-cards are digital cards that can be used to make payments online or in stores. They offer the same level of security as debit cards, but they are also more convenient to carry around.

Advantages of Checking Accounts

There are several advantages of checking accounts. They include:

- Interest on Balance

Interest may not be a given in every checking account. Some require that you have a minimum amount present to access the interest. The interest rate may not be much, but it is better than nothing.

- Low Maintenance Costs

These bank accounts may or may not have a maintenance cost. If there is a maintenance cost, it is usually low. If you do not incur an overdraft, you are safe. It may also not cost you anything to access your money from an ATM. Other banks will cover any ATM fees that occur.

- No Need to Carry Cash

Debit cards are traceable. So if someone steals your debit card, you can block it. However, cash is untraceable. You can get another debit card and continue with your daily transactions.

- Keep a Record of Your Spending

These accounts help you keep a record of your spending. It makes it easy to come up with a personal budget and stick to it. You can easily manage your spending.

Disadvantages of Checking Accounts

Read the fine print when opening a checking account. Otherwise, you will miss the disadvantages of these accounts. To help you along, here are a few.

- Organizations Can Track Your Spending Habits

Tracking your spending can be a disadvantage. Checking accounts create transactions that organizations can store and refer to in the future. Although they keep them with your permission, your spending habits can generate targeted advertising.

It may cause you to spend more money than your budget. So be careful which transactions you use your debit card. Sometimes, you can pay with cash.

To easily comprehend, go to this cocospy website. You may also create a guest blog post on it. And here you can find one of the best online web portal for the world breaking news inflact.

Visut here to get the latest news on gramhir. Here is the world best guest post site picuki.

- Not Every Account Is Free

Sometimes, there are costs when you are setting up your account. These costs may apply if you do not maintain your minimum balance. Sometimes, you may be careful and ensure you always keep the minimum balance. However, there may be other charges like new checks that may revert to your account.

- Financial Institutions Can Block Your Access

If a financial institution suspects that spending may not be yours, they can block the account. If it happens on a Friday, you will probably get access to your account on Monday. That may leave you without money to operate over the weekend.

If you are new to Instagram and want to get started with your social media journey, then Instalkr is a great tool to use. The free version allows you to follow other people’s stories and browse through their profile pictures. There are many advantages to using Ingramer for your Instagram account. It’s a user-friendly platform that doesn’t require a password and is easy to use.

You can follow different accounts and choose which ones you want to follow. You can also copy and republish any content you find on Instagram using Ingramer. Then, you can track your statistics on a personal dashboard. After setting up your account with Ingramer, all you have to do is follow the accounts you want to follow and keep track of them.

Conclusion

Checking accounts are advantageous. At the same time, you need to be careful. They are not for everyone. Evaluate all the key points and the terms and conditions of the bank before starting your checking account.

Sources:

https://www.investopedia.com/ask/answers/040715/what-are-pros-and-cons-online-checking-accounts.asp

https://www.forbes.com/advisor/banking/checking-vs-savings-accounts/